Table of Contents

What is the Difference?

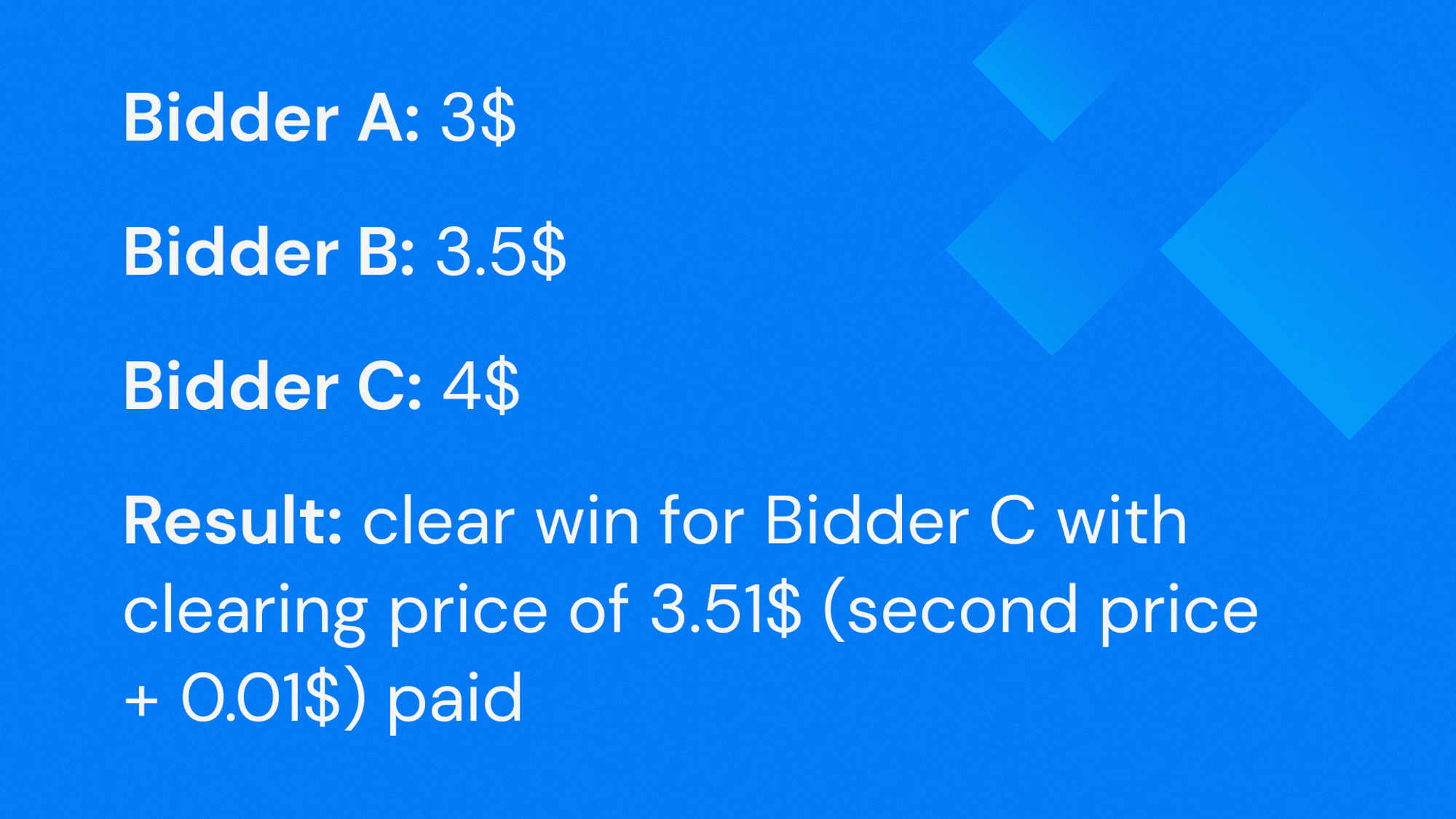

Although two auction models are used in advertising, second-price auctions are considered the primary type of bidding in the industry. Unlike first-price auctions, in these auctions, the winner pays the second highest bid +0.01$, which is also known as the clearing price.

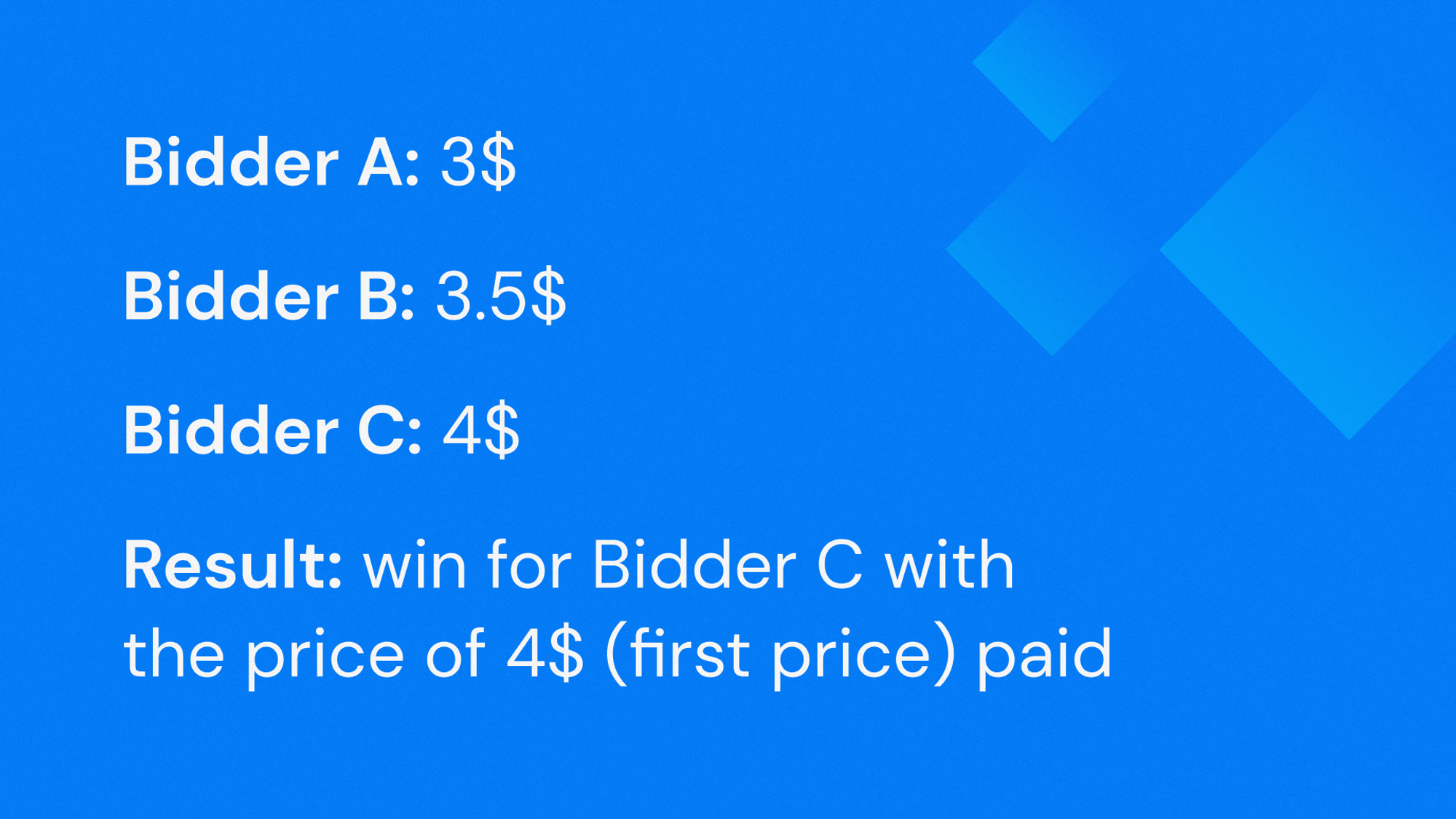

On the other hand, in the first-price model, the winner pays the exact amount that was initially submitted. Let’s explore more comprehensive explanation:

Second-Price Auction

Now Look at the First-Price Auction:

Floors

Besides all, it is worth remembering that the bid’s minimum price is called floor. They are needed to ensure that the ads are not sold at extremely low prices, profiting the publishers. There are two types of floors: Hard floors determine the very bottom price that publishers are willing to accept. All bids below this floor are eliminated and consequently not considered.

Example:

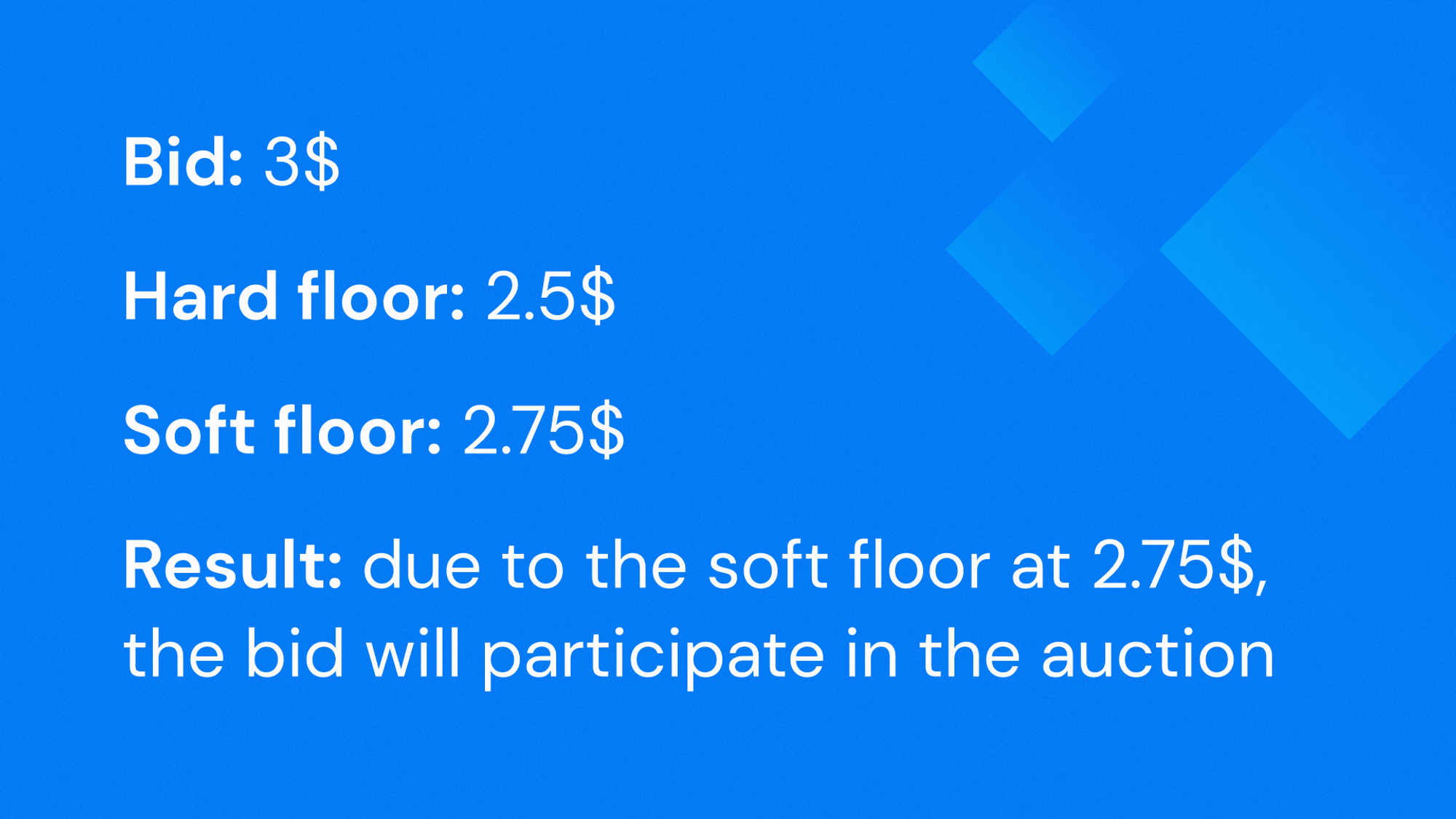

Soft floors show the price that publishers still accept. It exists to provide a range of prices, as the floor price is often unknown to the advertisers.

Example:

Result: due to the soft floor at 2.75$, the bid will participate in the auction.

Second to First Switch

Such a transition is occurring due to the industry’s quest for transparency and fairness. First-price auctions offer clear and straightforward pricing, where advertisers pay exactly what they bid, eliminating the uncertainty of second-price models that tend to protect advertisers. However, publishers have found ways to undermine this system to their advantage. By introducing soft floors, hard floors, and various fees and manipulations, publishers can artificially inflate the original CPM rate, driving up the final price beyond what the advertiser would have originally agreed to pay. These practices essentially negate the purpose of the second-price auction, converting it into a quasi-first-price auction, which is a hybrid of the two models.

Supply-Side

First-price auctions generally favor publishers, as they can maximize their ad revenue by taking the highest bid. Moreover, to minimize the loss from the reduction (difference in clearing price and initial bid) during second-price auctions, advertising platforms tend to include both hard and soft floors in the process of bidding.

Additionally, publishers are trying to make up for lost revenue from bid reductions in second-price auctions. To do this, SSPs and ad exchanges are now using a mix of soft and hard price floors, creating a hybrid auction model that combines aspects of both first- and second-price auctions. In this scenario, when both floors are implemented, bids that are lower than the hard floor are rejected instantly; whereas bids that are in between hard and soft floors take part in the first-price auctions unless there are ones higher than the soft floor which would participate in the second-price auctions.

Demand-Side

From the advertiser’s perspective, there is always a bit of uncertainty in case of second-price auctions. This is primarily due to the fact that ad exchanges along with numerous SSPs offer least to no transparency whatsoever, forcing advertisers to wonder what type of auction they are truly dealing with.

On the contrary, first-price auctions provide great visibility for the buyers due to the simplicity of the bidding mechanism in which, in case of winning, they are just paying the highest bid. Moreover, first-price auctions allow both supply and demand sides to see the hidden fees behind the bidding set up by the platform used in the process.

The downside though is that the advertisers now are paying full price with the risks of overpaying for the impressions. Thus, such first-price bidding is more sensible when advertisers are aware of the fair price for the impressions.

First-Price Auctions with Header Bidding

Header bidding allows SSPs to conduct an initial second-price auction before the final auction in a publisher’s ad server. If SSPs run a genuine second-price auction during this phase, less competitive bids get carried over to the final auction, resulting in notably low win rates. This phenomenon drives the shift toward first-price auctions.

When header bidding is conducted, buyers have a better chance of winning the ad impression compared to a second-price auction. This is because in a first-price auction, the buyer’s actual bid is the one that competes in the final auction, rather than the winning bid from a second-price auction being pushed to the ad server.

Conclusion

Overall, the shift towards first-price auctions reflects the industry’s ongoing efforts to balance the interests of publishers and advertisers while also addressing the complexities introduced by header bidding and other programmatic innovations. As the ecosystem continues to evolve, understanding the nuances of these auction models will be crucial for all stakeholders to optimize their strategies and ensure a fair and efficient digital advertising.