No longer is the ad tech ecosystem a niche corner of marketing; it’s the plumbing behind nearly every human interaction people have with brands in the digital age. Digital advertising underpinned an estimated $690 billion in global ad spend in 2024, and analysts point out that a network of panels of platforms had become highly fragmented, comprising over 200 different intermediaries, each with its own data and measurement priorities.

Table of Contents

This complexity creates both opportunity and confusion:

- On one hand, the technology allows ads to reach relevant audiences at scale;

- On the other hand, it introduces layers of fragmentation, interoperability issues, and potential waste.

Analysts at Deloitte predict that the supplier landscape will consolidate as larger companies acquire specialised competitors to improve services and scale, yet the overall structure remains layered and interconnected.

This article breaks down the ecosystem in simple terms.

So, stay tuned!

How Is the Ad Tech Ecosystem Explained?

Broadly, advertising technology is the software and infrastructure. It connects advertisers with audiences across websites, mobile apps, connected TVs, and other digital landscapes. It’s a constellation of platforms, data suppliers, and measurement tools. These can handle everything from bids to targeting to delivery to reporting.

LUMA Partners calls it a “far more complex ecosystem than most realize,” with hundreds of storefronts, each with unique data, measurement, and optimization practices. This fracture is what enables healthy margins for many providers, since there is little scale for any one player to construct a one‑size‑fits‑all solution.

To understand the ad tech ecosystem explained, imagine a series of pipes linking advertisers to publishers. Advertisers and their agencies set campaign goals and budgets. Demand‑side platforms (DSPs) turn those goals into real‑time offers for individual ad impressions. Those impressions come from publishers who use supply‑side platforms (SSPs) and ad exchanges to sell off their inventory through an auction.

They also tap into data management platforms (DMPs) and customer‑data platforms (CDPs), and apply audience along with context signals to those transactions. In the meantime, measurement providers verify the transactions for brand safety and performance.

Each layer has its own distinct function, but they all have to work together in harmony for campaigns to make an impact.

Core Layers of the Ad Tech Ecosystem

Demand Side: Advertisers, Agencies, and DSPs

Ad dollars from tiny e‑commerce brands to multinational consumer packaged goods companies power that ecosystem. Many collaborate with agencies or in‑house media teams to bring marketing objectives to life in digital advertising campaigns. Demand‐side platforms (DSPs) are these teams’ mission control consoles: they receive budgets, targeting criteria, and creatives, and then bid in real time to win impressions.

Popular DSPs include The Trade Desk, Google Display & Video 360, Amazon DSP, and BidsCube’s white‑label DSP, which can be deployed under your own brand in just days. DSPs typically work with data providers to create custom segments and ad verification services to filter non-human traffic.

Key functions of the demand side include:

- Audience targeting. Combining first‑party data with third‑party segments, look‑alike modelling, and contextual signals.

- Bid management. Setting bids by impression based on predicted value and pacing budgets across time.

- Creative management. Storing and rotating creatives, including dynamic creative optimisation.

- Reporting and attribution. Tying impressions to conversions and feeding insights back into the bidding algorithm.

Supply Side: Publishers, SSPs, and Ad Exchanges

On the sell side, publishers and app developers aggregate and make their ad space available to buyers. In compensation, supply‑side platforms (SSPs) enable publishers to manage inventory, set pricing floors, and plug into multiple exchanges to optimise yield. Major SSPs include Magnite, PubMatic, and Xandr, alongside niche providers like BidsCube’s white‑label SSP.

Ad exchanges intermediates between DSPs and SSPs for real‑time bidding and private marketplace deals. Some exchanges are part of larger platform ecosystems (e.g., Google AdX) and others function as standalone exchanges. Header bidding and pre‑bid server solutions enable publishers to auction the inventory to several SSPs at the same time and maximize competition.

- Yield optimisation. Adjusting price floors and prioritising deals to maximise revenue.

- Inventory packaging. Segmenting placements by format, audience, or context to create premium packages.

- Brand safety controls. Blocking categories, advertisers, or creatives that conflict with the publisher’s policies.

- Reporting and analytics. Providing transparency on buyers, bids, win rates, and fees.

Data and Identity Layer

Data is the lifeblood of digital advertising. Data management platforms (DMPs) aggregate third‑party and second‑party segments; customer‑data platforms (CDPs) centralise first‑party data from CRM systems, websites, and apps. Identity resolution providers map identifiers across devices and cookies. These tools enable people‑based targeting, frequency capping, and analytics.

In a world where third‑party cookies are vanishing and privacy regulations are tightening, the ability to activate high‑quality first‑party data is becoming a key differentiator. According to the IAB Tech Lab, the Privacy Sandbox will rebuild digital advertising transactions inside the browser, shifting data flows while supporting an industry worth $690 billion.

Data and identity services include:

- Onboarding. Matching offline CRM data to online identifiers using hashed email addresses or phone numbers.

- Audience enrichment. Adding demographic or behavioural attributes from trusted data providers.

- Identity graphs. Linking multiple device IDs and cookies to a person or household while respecting privacy laws.

- Clean rooms. Secure environments where brands and publishers can match and analyse data without exposing raw user information.

Measurement, Verification, and Safety

No campaign is a campaign without measurement. Verification vendors such as DoubleVerify and Integral Ad Science ensure that ads are both viewable and served in brand‑safe environments. Metric suppliers examine the time people spend engaging with the creative. Incrementality and multi‑touch attribution partners inform marketers on what actually led to the outcome.

Standards are being set for measurement, and solutions are being designed to eliminate invalid traffic and fraud by regulatory and industry bodies – such as the IAB Tech Lab. Transparency continues to be a major problem: LUMA notes that ad tech supply stack fragmentation is preventing standardisation and perpetuating frothy margins. Improved interoperability and common measurement frameworks are critical for progress.

Creative and Retail Media Layers

Creatives are not just banners. Dynamic creative optimisation (DCO) platforms deliver messages dynamically, depending on user data, context and device. Asset and workflow centralisation, and legal and brand compliance. Creative management platforms that centralise assets and workflows, as well as compliance tools that check against all types of legal and brand standards.

Retail media networks, marketplaces run by retailers themselves, like Amazon, Walmart, or Target, have become a potent new layer. They allow advertisers to target ads at shoppers based on first‑party purchase data. This marriage of commerce and media has erased the distinction between marketing and shopping, driving up incremental sales and boosting ROAS for brands.

Key Players in Each Layer

The ad tech ecosystem map below groups representative players by function. The list is not exhaustive but illustrates the breadth of the market. Some companies operate across multiple layers; for example, Google and Amazon each own ad servers, DSPs, data tools, and exchanges. Others specialise in a niche, such as measurement or creative optimisation.

| Layer | Representative Players | Notes |

| Advertisers & Agencies | Brands, holding company agencies (WPP, Omnicom, Publicis), and independent shops | Set goals, budgets, and creative direction |

| Demand‑Side Platforms | The Trade Desk, Google DV360, Amazon DSP, MediaMath, BidsCube (white‑label) | Central bidding engines; integrate data and analytics. |

| Ad Servers & Tag Management | Google Campaign Manager, Sizmek, Flashtalking | Store and deliver creatives, track impressions, and clicks |

| Data & Identity | LiveRamp, Acxiom, Experian, TransUnion, Neustar | Provide third‑party data, identity graphs and onboarding services |

| Supply‑Side Platforms | Magnite, PubMatic, Xandr, Index Exchange, BidsCube (white‑label) | Package and sell inventory; manage yield and deals |

| Ad Exchanges & Marketplaces | OpenX, Google AdX, Yahoo Exchange, BidsCube WL Ad Exchange | Facilitate auctions and private deals |

| Retail Media Networks | Amazon Ads, Walmart Connect, Target’s Roundel, Kroger Precision Marketing | Mix advertising with first‑party purchase data |

| Measurement & Verification | DoubleVerify, Integral Ad Science, Moat, Comscore, Nielsen | Provide viewability, attention, and brand‑safety metrics |

| Creative & DCO | Celtra, Innovid, Adobe Ad Cloud Creative | Manage assets and generate personalised creatives |

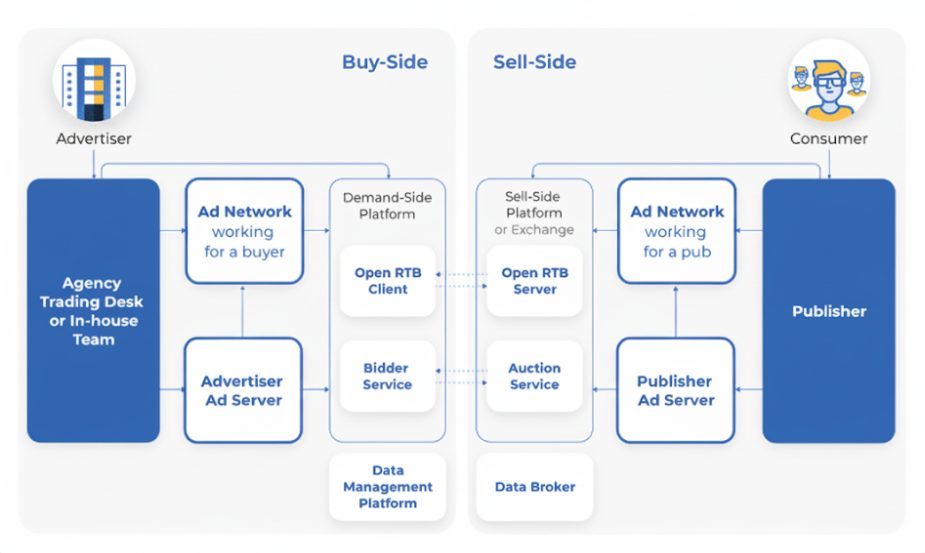

Visual Map: Ad Tech Ecosystem Diagram

Here is the ad tech ecosystem diagram. The left side is for advertisers and agencies; the middle boxes represent the demand‑side platform, data and identity services, ad exchange, and supply‑side platform; and the right side is for publishers. Arrows show how budgets, data, and bid requests move between layers.

This ad tech ecosystem map summarises the high‑level interactions and highlights the complexity of the system.

- Advertisers & Agencies → DSP. Brands and agencies send budgets, briefings, and creatives to DSPs. DSPs decide which impressions to bid on.

- DSP ↔ Data & Identity. DSPs tap audience data and identity services to refine targeting and estimate value. These data providers also inform SSPs and publishers about user segments.

- DSP → Ad Exchange → SSP. Winning bids travel through the exchange to the supply side. Ad exchanges run auctions and route transactions to SSPs, which then deliver the creative to the publisher’s site or app.

- Measurement loop. After the ad is served, verification and measurement vendors collect data on viewability, engagement, and conversions. These insights inform future bids and help refine audience segments.

How Data Flows Through the Ecosystem

The path from an impression to a conversion involves multiple handshakes and data exchanges. Understanding this flow is crucial for optimising campaigns and ensuring transparency.

Step‑By‑Step Data Flow

Step #1. User visit triggers an ad request. When a user accesses a page or app, the publisher’s ad server identifies available slots and sends out a bid request to the SSP.

Step #2. SSP packages the request. SSP augments the request with some context data (page category, device type, location) and passes it to ad exchanges and their partner DSPs.

Step #3. DSP evaluates and bids. Bid request is cross‑checked by the DSP against campaign targeting rules, using third‑party and first‑party data. It makes a bid, and it responds in milliseconds.

Step #4. Auction and creative delivery. The ad exchange holds an auction among all bids and selects the highest qualified bid. The winning bid is reported back to the SSP, and the publisher’s ad server is told to load the creative.

Step #5. Measurement and reporting. Once the ad is served, measurement tags record impressions, clicks, viewability, and conversions. Data gets sent back to DSPs, advertisers, and verification partners for review and optimisation.

Industry groups are working to streamline these flows. The Google Privacy Sandbox will recreate many of these transactions directly in the browser and change how auctions, attribution, and creative rendering happen, the IAB Tech Lab notes. The goal of such efforts is to keep advertising functional – but privacy-friendly, and it will need to work across all levels.

Use Case: Building Your Own Stack or Choosing Partners

Brands and publishers face a strategic question: Should you build your own ad tech stack or partner with established providers?

The answer depends on resources, expertise, and strategic priorities. Below is a decision framework that compares the two approaches across key criteria:

Building Your Own Stack

Pros:

- Full control over bidding algorithms, data usage, and privacy.

- High customisation, enabling unique features tailored to your business.

- Own your data. First-party data never leaves your environment, reducing leakage.

Cons:

- High cost and complexity. You must invest in development, hosting, and maintenance.

- Longer time to market. Building and certifying a platform can take months or years.

- Requires specialised talent in ad operations, data science, and security.

Choosing Partners

Pros:

- Faster deployment and immediate access to premium inventory and sophisticated features.

- Scalable infrastructure managed by experts, with updates and optimisations included.

- Lower initial cost through subscription or revenue‑share models.

Cons:

- Less control over the roadmap and data governance.

- Customisation limits. You depend on the vendor’s feature set and integration roadmap.

- Potential vendor lock‑in if contracts or technical dependencies make switching difficult.

BidsCube offers a hybrid solution through its white‑label products. You can deploy a fully branded DSP, SSP, or video ad server under your own name, with dedicated infrastructure and full access to settings. This combines the control of a bespoke build with the speed of a partner solution.

Expert Insight: Building Trust and Interoperability

“Interoperability is an engineering rule for us, not a slide. We build on open standards like oRTB and VAST. Data paths stay observable end to end. You keep control of models and first-party data. A white-label core gives you speed without losing ownership.” – Dmitriy Iliashenko, Chief Technology Officer at BidsCube.

Dmytro’s perspective underscores the importance of trust and collaboration in an era when privacy regulations and AI adoption are reshaping the industry. As Deloitte notes, the supplier landscape will consolidate choosing partners that are transparent and flexible will help you thrive during this transition.

Our tech staff and AdOps are formed by the best AdTech and MarTech industry specialists with 10+ years of proven track record!

Conclusion

The ad tech ecosystem diagram may look complicated, but at its heart lies a simple goal: delivering the right message to the right person at the right moment. Achieving this requires collaboration among advertisers, technology providers, data companies, and publishers.

Recognising where each layer begins and ends, and who controls, helps marketers allocate budgets wisely and publishers protect their audiences. The system is evolving: Privacy regulations are reshaping data flows, AI is automating workflows, and market consolidation is reducing the number of intermediaries. Yet the fundamental building blocks remain: demand, supply, data, and measurement.

As you navigate the ad tech ecosystem, keep these principles in mind:

- Focus on interoperability and transparency. Fragmentation and closed systems limit the value you can extract.

- Invest in first‑party data and identity solutions. They are becoming the currency of addressable advertising.

- Choose partners that align with your objectives and offer flexible integration options. White‑label platforms like those from BidsCube can give you the best of both worlds: control and speed.

- Stay informed about regulatory changes and industry standards. Initiatives like the Privacy Sandbox will shift how auctions and attribution work.

Understanding this landscape is not just academic. It is the foundation of successful marketing and monetisation in the digital age. Use the maps, tables, and insights in this article to chart your own path through the pipes and make choices that maximise return for your business.

Contact us and get even more insights along with a roadmap for your potential solution or product.